The world of digital collectibles witnessed one of its most spectacular downfalls when pop superstar Justin Bieber’s Bored Ape NFT investment plummeted from a staggering $1.3 million purchase price to a meager $12,000 valuation. This dramatic collapse represents far more than just one celebrity’s financial misstep. It serves as a cautionary tale about the volatile nature of non-fungible tokens, the dangers of purchasing assets during market euphoria, and the ultimate reality check that befell the NFT market after its meteoric rise in 2021 and 2022. When Justin Bieber paid $1.3 million for a Bored Ape NFT in January 2022, he joined an exclusive club of celebrities and investors who believed these digital assets represented the future of art, culture, and investment. Today, that confidence has been shaken to its core.

The Golden Era: When Justin Bieber Bought His Bored Ape NFT

In January 2022, the NFT market was experiencing unprecedented growth and mainstream adoption. Celebrities, athletes, and business moguls were rushing to acquire their own pieces of digital history, particularly from the prestigious Bored Ape Yacht Club collection. Justin Bieber’s Bored Ape NFT purchase came at the absolute peak of this frenzy, when owning a Bored Ape wasn’t just about having a unique digital image—it was about status, community membership, and perceived investment potential.

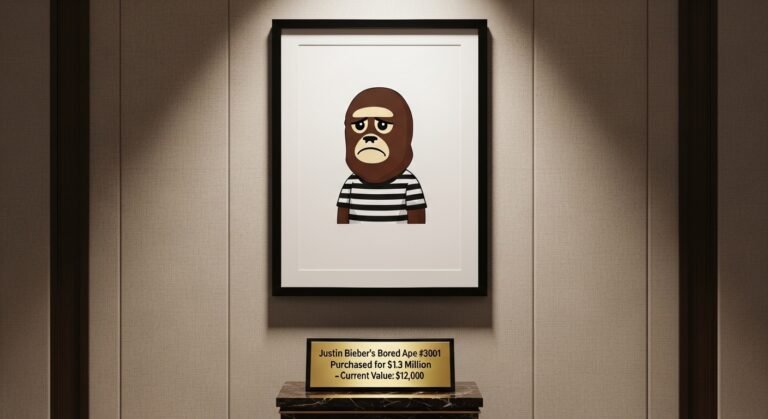

The specific Bored Ape that Justin Bieber paid $1.3 million for was Bored Ape #3001, featuring a tan fur ape with heart-shaped sunglasses and a striped shirt. At the time of purchase, the pop sensation paid 500 Ethereum, which converted to approximately $1.3 million based on cryptocurrency values in January 2022. Industry observers immediately noted that Bieber had paid roughly 300% above the floor price—the minimum price for any Bored Ape NFT at that time—suggesting either extreme enthusiasm or potentially poor investment advice.

Understanding the Bored Ape Yacht Club Phenomenon

To comprehend the magnitude of the Bored Ape NFT value crash, one must first understand what made these digital collectibles so desirable. Created by Yuga Labs in April 2021, the Bored Ape Yacht Club consists of 10,000 unique cartoon ape images, each with different traits, accessories, and characteristics. The project quickly became the crown jewel of the NFT ecosystem, attracting celebrity owners including Madonna, Eminem, Snoop Dogg, Paris Hilton, and Jimmy Fallon.

The Bored Ape Yacht Club promised more than just digital artwork. Owners received membership to an exclusive community, access to special events, intellectual property rights to their specific ape, and airdrops of additional NFTs including Mutant Apes and virtual land in the Otherside metaverse. This combination of social status, utility, and investment potential created a perfect storm of demand that drove prices into the stratosphere during 2021 and early 2022.

When Justin Bieber bought his Bored Ape NFT, the collection’s floor price sat around $400,000, with rare traits commanding significantly higher premiums. The cultural cachet associated with owning a Bored Ape made it the ultimate status symbol in both digital and entertainment circles. Major brands partnered with Yuga Labs, and speculation swirled about future developments that would increase the value and utility of these digital assets.

The Great NFT Market Collapse of 2022-2023

The dramatic decline in Justin Bieber’s Bored Ape NFT worth didn’t happen in isolation. It coincided with a broader collapse of the entire NFT market that saw trading volumes plummet by over 95% from their peak. Several interconnected factors contributed to this spectacular crash that turned millions of dollars in digital assets into what some critics derisively called “worthless JPEGs.”

The cryptocurrency winter that began in mid-2022 fundamentally undermined the NFT ecosystem. Since NFTs are typically purchased using Ethereum, the cryptocurrency’s value decline from over $4,800 in November 2021 to under $1,000 by mid-2023 immediately impacted NFT prices. Even if Bored Ape prices had remained stable in Ethereum terms, their dollar value would have plummeted alongside the underlying cryptocurrency.

Beyond cryptocurrency volatility, the NFT market crash reflected a sobering reassessment of value propositions. As the initial hype faded, investors began questioning what they actually owned. Unlike physical art or real estate, NFTs provided neither tangible assets nor clear legal frameworks. The realization that most NFT projects would never generate meaningful utility or return on investment triggered a mass exodus from the market.

Regulatory concerns also dampened enthusiasm. Government agencies worldwide began scrutinizing NFT projects for potential securities violations, money laundering risks, and consumer protection issues. Celebrity endorsements like Justin Bieber’s Bored Ape NFT purchase came under particular scrutiny, with questions arising about disclosure requirements and whether stars were compensated for promoting these digital assets.

Celebrity NFT Investments: A Pattern of Losses

Justin Bieber’s Bored Ape NFT loss represents just one example of celebrity NFT investments gone wrong. Paris Hilton purchased multiple Bored Apes and promoted them heavily on social media, only to watch their values plummet. DJ Steve Aoki, an early NFT enthusiast who invested millions, has seen most of his collection depreciate dramatically. Even savvy investors and entrepreneurs found themselves caught in the downturn.

The celebrity factor actually contributed to inflated prices during the boom period. When famous individuals purchased NFTs and promoted them to millions of followers, it created artificial demand and FOMO—fear of missing out—among fans and retail investors. This dynamic pushed prices far beyond sustainable levels, setting up inevitable corrections once the hype cycle ended.

Critics have argued that many celebrities either didn’t understand the assets they were promoting or failed to disclose financial relationships with NFT projects. In some cases, stars received free NFTs or payment to promote collections, creating undisclosed conflicts of interest. While there’s no evidence that Justin Bieber’s Bored Ape NFT acquisition involved such arrangements, the broader pattern raised ethical questions about celebrity influence in speculative markets.

The Current State of Bored Ape NFT Values

As of early 2025, the Bored Ape Yacht Club collection has stabilized at dramatically reduced price levels. The floor price—the minimum cost to purchase any Bored Ape—hovers around 10-15 Ethereum, which translates to approximately $25,000 to $40,000 depending on cryptocurrency fluctuations. This represents an 85-90% decline from peak values in early 2022.

Justin Bieber’s Bored Ape NFT current value of approximately $12,000 reflects an even steeper decline than the collection average. Several factors explain why his specific ape has underperformed. First, he paid a massive premium over floor price when purchasing, buying during peak mania rather than accumulating strategically. Second, the traits on Bored Ape #3001, while visually appealing, aren’t particularly rare within the collection’s hierarchy of desirability.

The broader Bored Ape market has also suffered from oversupply and diminished cultural relevance. Yuga Labs expanded the ecosystem with Mutant Apes, Otherside land, and various other offerings, diluting attention and resources across multiple projects. Meanwhile, newer NFT collections and blockchain innovations have diverted interest away from the original Bored Ape concept that once dominated headlines.

What Went Wrong: Analyzing the Investment Failure

The Bored Ape NFT investment failure stemmed from multiple miscalculations that plague many speculative bubbles. Perhaps most fundamentally, buyers during the peak period confused price momentum with underlying value. Just because assets were appreciating rapidly didn’t mean those gains were sustainable or justified by fundamentals.

Justin Bieber paid $1.3 million for a Bored Ape NFT based on expectations that prices would continue rising indefinitely. This greater fool theory—the idea that someone else would pay even more in the future—underpinned much of the NFT market during its euphoric phase. When new buyers stopped entering the market in sufficient numbers, the entire price structure collapsed.

The lack of cash flow or productive use also doomed most NFT investments to eventual decline. Unlike stocks that represent ownership in profit-generating businesses, or real estate that can generate rental income, NFTs produced no inherent returns. Their value depended entirely on collective belief and finding future buyers willing to pay more. Once that belief evaporated, values crashed toward zero.

Technological limitations further undermined long-term viability. Most NFTs, including Bored Apes, exist on blockchain but the actual image files are stored on separate servers. If these servers go offline or companies maintaining them cease operations, NFT owners could lose access to the very images they purchased. This technical reality contradicted narratives about permanent digital ownership.

Lessons for Digital Asset Investors

The saga of Justin Bieber’s Bored Ape NFT value crash offers crucial lessons for anyone considering investments in digital collectibles, cryptocurrencies, or other emerging asset classes. First and foremost, celebrity involvement should never substitute for fundamental analysis. Famous people make terrible investment choices just like everyone else, often worse due to excess capital and poor advice.

Understanding intrinsic value remains essential even in digital markets. Before investing substantial sums in any asset, investors should identify what generates value independent of market sentiment. Does the asset produce income? Does it have utility beyond speculation? Can its value be reasonably estimated using objective criteria? Bored Ape NFTs ultimately failed these tests for most buyers.

Market timing matters tremendously in speculative assets. Justin Bieber bought his Bored Ape NFT at literally the worst possible moment—the market peak during maximum hype. Investors who accumulated Bored Apes during 2021 when prices were lower and exited before the crash could have realized substantial profits. Those who bought during the frenzy and held through the decline suffered devastating losses.

Diversification protects against catastrophic losses in any single asset class. Concentrating wealth in highly speculative digital collectibles represents extreme risk that’s inappropriate for most investors. Even enthusiasts who believed in NFT potential should have limited exposure to amounts they could afford to lose completely.

The Future of NFT Markets and Digital Collectibles

Despite the spectacular crash of Bored Ape NFT values and the broader market collapse, the technology and concept of non-fungible tokens haven’t disappeared entirely. Instead, the market has matured beyond pure speculation toward use cases with genuine utility. Digital ticketing, gaming assets, supply chain verification, and intellectual property management represent potentially sustainable applications of NFT technology.

Several factors could influence whether Bored Ape NFTs specifically experience any recovery. Yuga Labs continues developing the Otherside metaverse and other projects that could add utility to original Bored Ape ownership. If these initiatives succeed in creating engaging experiences or valuable benefits, demand for Bored Apes might stabilize or even increase modestly.

However, expecting Justin Bieber’s Bored Ape NFT to return to its $1.3 million purchase price requires almost impossible circumstances. The combination of factors that drove peak prices—cryptocurrency bull market, NFT mania, celebrity involvement, FOMO psychology, and mainstream media attention—seems unlikely to align again in the same way. More probably, Bored Apes will settle into niche collectible status with modest values sustained by a small community of enthusiasts.

The NFT market evolution points toward differentiation between serious projects with utility and pure speculation. Digital assets that solve real problems or enable new experiences may thrive. Those that exist primarily as status symbols or get-rich-quick schemes will likely continue declining or maintaining minimal values supported only by nostalgia and cultural significance.

Regulatory and Legal Implications

The celebrity NFT losses exemplified by Justin Bieber’s experience have attracted regulatory attention worldwide. Securities regulators are examining whether certain NFT offerings should be classified as investment contracts requiring registration and disclosure. Consumer protection agencies are investigating potentially deceptive marketing practices, particularly when celebrities promote digital assets without proper disclosures.

Several class-action lawsuits have been filed against NFT projects and celebrity promoters, alleging securities fraud and misleading advertising. While Justin Bieber’s Bored Ape NFT purchase appears to have been a personal investment rather than a promotional arrangement, the broader regulatory environment could impact future digital collectible markets.

Tax implications also loom large for NFT investors who realized losses. In many jurisdictions, NFT sales trigger capital gains or losses that must be reported to tax authorities. Justin Bieber’s Bored Ape NFT value decline represents a potential tax deduction if he sells at current prices, though he would need to establish cost basis and document the transaction properly.

Conclusion

The story of how Justin Bieber’s Bored Ape NFT plummeted from $1.3 million to $12,000 serves as one of the most vivid cautionary tales in modern investment history. It encapsulates the dangers of speculative bubbles, celebrity influence, market timing failures, and the confusion between price and value that plague many emerging asset classes.

For investors considering NFT investments or other digital collectibles, this episode reinforces timeless wisdom: don’t invest in what you don’t understand, be skeptical of get-rich-quick narratives, diversify your portfolio, and remember that sustainable value comes from utility and cash flows rather than pure speculation.

The Bored Ape NFT market may never return to its 2022 heights, but the broader technology and concept could still find legitimate applications. As the dust settles on this particular mania, future digital asset markets will hopefully incorporate lessons learned and develop more sustainable foundations.

Are you navigating the complex world of digital assets and cryptocurrency investments? Stay informed about NFT market trends, cryptocurrency valuations, and digital collectible investing by following expert analysis and avoiding the hype cycles that trapped even celebrities like Justin Bieber. Remember: if an investment seems too good to be true or requires you to find a greater fool, it probably is. Make informed decisions based on fundamental value, not celebrity endorsements or fear of missing out.

See more;Bitcoin Mining Zetahash Era: Profitability Analysis 2026