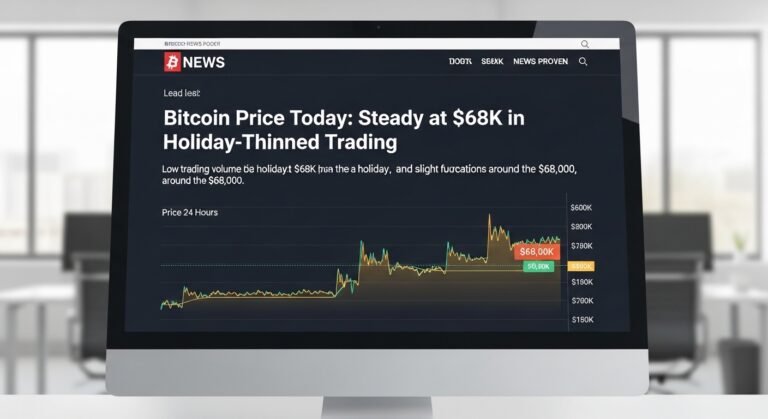

The Bitcoin price today continues to hold firm near the $68,000 mark, defying expectations of a sharper pullback as global financial markets wind down for a major holiday period. In what traders are calling a display of remarkable resilience, BTC is trading steady at $68K even as trading volumes thin considerably — a pattern historically associated with unpredictable price swings due to lower liquidity. Yet this time around, the world’s largest cryptocurrency is showing a composed, almost clockwork-like price action that has left both bulls and bears watching cautiously from the sidelines.

Market participants are paying close attention to the Bitcoin price today in holiday-thinned trade, partly because this kind of environment — characterized by reduced institutional participation and lighter order books — can often amplify volatility in both directions. The fact that BTC is holding $68K suggests underlying demand is still strong, with buyers stepping in to absorb any dips. Whether this plateau becomes a launching pad for a fresh rally or gives way to a correction is the central question dominating crypto discussions right now.

Why Bitcoin Price Today Is Holding Steady at $68K

To understand why the Bitcoin price today is steady at $68K, it’s essential to look at the confluence of forces supporting this price level. First and foremost, the broader macro environment has been increasingly favorable for risk assets. Easing inflation data, a more dovish tone from central banks, and renewed institutional interest in Bitcoin have collectively built a strong support structure under the current price.

Beyond macro factors, the crypto market is also absorbing the narrative of the Bitcoin halving cycle. Historical data consistently shows that the 12–18 months following a halving event tend to be bullish for BTC. With that backdrop in play, any dips toward $66K–$67K are being met with significant buy pressure, reinforcing the $68K level as a new zone of consolidation.

The Role of Holiday Trading Volume in BTC Price Action

One of the most discussed factors behind today’s Bitcoin price stability is the sharp drop in trading volume caused by the holiday period. During these times, many institutional desks reduce staffing, algorithmic trading activity decreases, and retail sentiment tends to be less reactive to short-term news cycles. The result is a market that moves slowly and deliberately — or sometimes barely moves at all.

Analysts note that low-volume Bitcoin trading environments during holidays can actually be a bullish signal in disguise. When sellers are unable to push price down despite thin liquidity, it demonstrates the strength of the current support base. The fact that BTC is holding $68K in holiday-thinned trade is therefore being interpreted by many as a sign that larger players — often referred to as ‘whales’ — are not liquidating their positions but rather accumulating quietly.

Key Support and Resistance Levels to Watch

For traders and investors closely monitoring the Bitcoin market today, a few critical price levels deserve attention. The $67,000–$67,500 range has emerged as strong support, where previous buying interest was observed multiple times in recent sessions. On the upside, the psychological barrier at $70,000 remains the most watched resistance level — breaking above it with conviction would likely trigger a new wave of momentum buying.

Technical analysts using on-chain data point to the 200-day moving average and the realized price for short-term holders as additional reference points. Currently, both these metrics sit comfortably below the spot price, which reinforces the view that the broader Bitcoin price trend remains constructively bullish despite the near-term consolidation.

Institutional vs. Retail Sentiment in Today’s BTC Market

One of the defining characteristics of the current Bitcoin price environment is the stark divergence between institutional and retail behavior. Institutional players — ranging from publicly listed companies holding Bitcoin on their balance sheets to Bitcoin ETF issuers — have been steady buyers over recent months. This structural demand acts as a floor beneath price, explaining in large part why BTC hasn’t experienced the kind of devastating drawdowns seen in previous cycles.

Retail participants, on the other hand, tend to be more sentiment-driven. During holiday periods, retail volumes drop even further, meaning the market is left largely to institutional and high-net-worth actors who have longer time horizons and are less likely to panic sell over short-term price fluctuations. This dynamic lends credibility to the view that the Bitcoin price today is a fairly accurate reflection of deliberate, informed positioning rather than speculative frenzy.

Spot Bitcoin ETFs and Their Impact on Price Stability

The approval and subsequent popularity of spot Bitcoin ETFs in the United States has fundamentally changed the demand dynamics for BTC. These products allow traditional investors — pension funds, family offices, registered investment advisors — to gain exposure to Bitcoin through regulated, familiar financial instruments. The daily inflows into these ETFs represent consistent, structural buying pressure that has helped smooth out some of Bitcoin’s historically extreme volatility.

During the current holiday-thinned period, Bitcoin ETF inflows have moderated but have not reversed. This steady, if reduced, flow of capital into the asset helps explain why the BTC price is holding steady at $68K rather than experiencing a more pronounced holiday dip. Market observers widely credit the ETF ecosystem as one of the most transformative developments in Bitcoin’s price history, fundamentally altering the supply-demand equation.

Bitcoin Price Today — On-Chain Metrics Tell a Deeper Story

Beyond the surface-level chart analysis, on-chain data provides valuable context for understanding the current Bitcoin price today. Several key metrics are flashing signals that align with a constructive price outlook. The Bitcoin HODL waves — which track the age distribution of BTC in circulation — show that a significant proportion of coins have not moved in over a year. This long-term holder behavior typically indicates strong conviction among Bitcoin’s most committed investors.

Additionally, the exchange reserves for Bitcoin have been declining steadily, indicating that investors are moving BTC off exchanges and into cold storage. This withdrawal of supply from immediately tradable reserves creates a natural scarcity effect, putting upward pressure on price. When combined with the ongoing post-halving supply reduction — which cut the daily issuance of new BTC by 50% — the supply-side picture looks decidedly supportive for sustained price levels.

Market Sentiment Indicators During Holiday Season

Sentiment tools like the Crypto Fear & Greed Index currently show the market hovering in the ‘Greed’ territory, though not yet at the extreme levels that have historically preceded major corrections. This calibrated optimism suggests that while the market is feeling positive about the Bitcoin price outlook, it hasn’t yet reached the kind of euphoric excess that tends to signal short-term tops.

Social media sentiment tracking, another popular tool among crypto traders, shows a similar picture — positive but measured. Conversations around the BTC price at $68K are more analytical than emotional, with many community members discussing support levels, potential catalysts, and portfolio strategy rather than engaging in the hype-driven behavior typical of earlier market peaks. This maturity in market discourse is itself a signal of an evolving, deepening market.

Global Macro Context Shaping Bitcoin’s Price Today

No analysis of the Bitcoin price today would be complete without examining the global macroeconomic backdrop. Several major economic narratives are actively shaping how investors approach Bitcoin as an asset class. The trajectory of U.S. interest rates remains perhaps the most significant external driver. As the Federal Reserve shifts toward a more accommodative monetary policy stance, the opportunity cost of holding non-yielding assets like Bitcoin decreases — a dynamic that historically has supported higher BTC valuations.

Currency debasement concerns — amplified by record levels of government debt across major economies — continue to drive some investors toward Bitcoin as a digital store of value. This ‘digital gold’ narrative has gained significant traction among traditional finance circles over the past two years, bringing a new category of buyers into the market who are less focused on short-term price action and more interested in long-duration exposure to a scarce, decentralized asset.

Geopolitical Uncertainty and Bitcoin’s Safe-Haven Appeal

Geopolitical instability in various regions has also contributed to Bitcoin’s appeal as a censorship-resistant financial asset. In countries experiencing currency crises, capital controls, or political turmoil, Bitcoin has emerged as a practical tool for wealth preservation and cross-border value transfer. This real-world utility — distinct from speculative trading — adds a fundamental demand component to the Bitcoin price equation that is often underappreciated in mainstream financial media.

What Could Move Bitcoin Price Beyond $68K?

For those wondering what catalysts could push the Bitcoin price decisively beyond its current $68K holding pattern, several scenarios stand out. A clearer regulatory framework in major economies — particularly in the United States and European Union — would reduce uncertainty and likely encourage greater institutional participation. Similarly, any additional approvals of cryptocurrency investment products in new markets would broaden the accessible investor base and introduce fresh capital.

On the technical side, a confirmed weekly close above $70,000 would likely trigger a cascade of algorithmic buy orders and momentum-following strategies, potentially accelerating the pace of price appreciation. Many Bitcoin price predictions from analysts at major financial institutions target the $80,000–$100,000 range as a medium-term possibility, contingent on continued ETF inflows and favorable macro conditions. While these targets are speculative, they provide a sense of the scale of opportunity that market participants are positioning for.

Risks That Could Pressure BTC Below Current Levels

Of course, no balanced market analysis would be complete without acknowledging the downside risks. The primary threat to the current Bitcoin price stability at $68K is an unexpected shift in macroeconomic conditions — whether that’s a surprise inflation resurgence that forces central banks to turn hawkish again, or a sudden deterioration in risk appetite driven by geopolitical events or financial market stress.

Regulatory crackdowns in major markets, while considered less likely given the current political climate, remain a perennial concern for Bitcoin investors. Large-scale exchange hacks or security incidents could also temporarily dent sentiment, as could coordinated selling by large holders. Understanding these risks is crucial for anyone making decisions based on the current Bitcoin price today.

Bitcoin Price History — Context for the $68K Level

To appreciate the significance of the Bitcoin price today at $68K, it helps to place this level in historical context. Bitcoin first approached $68,000 during the bull run of late 2021, when it briefly touched an all-time high near $69,000 before a prolonged bear market pulled it back to lows of around $16,000 in late 2022. The recovery to current levels represents not just a price milestone but a fundamental re-rating of the asset.

The journey from those 2022 lows back to $68K has been marked by structural improvements in the ecosystem: the launch of regulated Bitcoin ETFs, growing adoption by corporations and nation-states, the completion of the 2024 halving event, and the maturation of the broader crypto market infrastructure. Each of these developments has helped convert more skeptics into holders and positioned Bitcoin as a more permanent fixture of the global financial landscape.

Related Keywords & First-Page Search Intent Terms

To maximize the reach of this article and capture related search traffic, the following LSI (Latent Semantic Indexing) keywords and high-volume related search terms should be integrated naturally throughout the content:

Conclusion

The Bitcoin price today, holding steady at $68K amid holiday-thinned trade, tells a nuanced story about the current state of the crypto market. It reflects a market that is neither complacent nor panicked, but quietly confident — supported by structural demand from institutional investors, the positive effects of the halving cycle, and a macro environment that is gradually becoming more hospitable to risk assets.

The reduced trading volume of the holiday period, rather than exposing Bitcoin to outsized downside risk, has instead revealed the strength of the bid beneath the market. Sellers have been unable to push price down meaningfully, while buyers continue to step in at support — a dynamic that bodes well for the medium-term trajectory of BTC.

Whether you are a long-term Bitcoin holder, an active trader, or someone still evaluating their first crypto investment, keeping a close eye on the Bitcoin price today and the factors driving it is essential for informed decision-making. The confluence of on-chain fundamentals, macro tailwinds, and technical price action all point toward a market that remains in a broadly constructive phase, even as short-term consolidation continues.

Stay updated with real-time Bitcoin price movements, bookmark your preferred crypto data sources, and follow expert market analysis to navigate this exciting — and sometimes unpredictable — asset class with confidence. If you found this analysis valuable, share it with fellow investors and check back regularly for updated Bitcoin price today coverage as market conditions evolve.

See more;Bitcoin Hits $68K—Why Long-Term Holders Aren’t Flinching