Coin analysis has become the cornerstone of successful cryptocurrency investing, especially as digital assets continue to evolve in 2025. Whether you’re a seasoned trader or just starting your crypto journey, mastering coin analysis is essential for making informed investment decisions in today’s volatile market. This comprehensive guide will walk you through the three primary methods of coin analysis: technical analysis, fundamental analysis, and on-chain analysis. With Bitcoin trading around $117,000 and the crypto market showing strong bullish momentum, understanding these analytical approaches has never been more crucial for investors looking to navigate the complex world of cryptocurrency investing. Any particular geographic focus

What is Coin Analysis?

Coin analysis refers to the systematic evaluation of cryptocurrency projects and their tokens to determine their investment potential, intrinsic value, and future price movements. This process involves examining various factors, including market data, project fundamentals, technical indicators, and blockchain metrics, to make informed trading or investment decisions.

The Three Pillars of Effective Coin Analysis

Modern cryptocurrency analysis relies on three complementary approaches that work together to provide a complete picture of any digital asset’s potential.

Technical Analysis in Coin Analysis

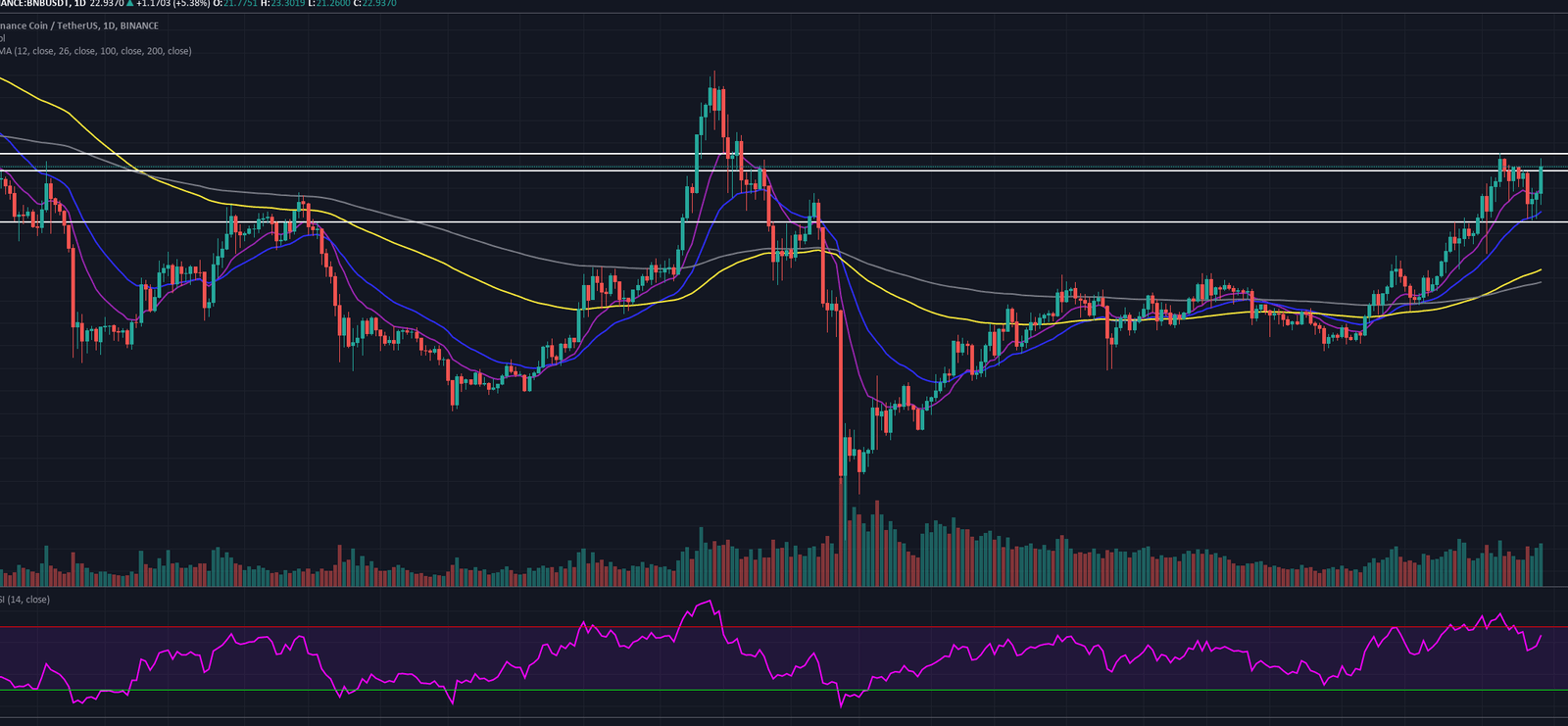

Technical analysis forms the backbone of short-term trading strategies and focuses on price patterns, chart formations, and market indicators. This method examines historical price data to predict future price movements.

Key Technical Indicators for Coin Analysis

Moving averages, RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and Bollinger Bands are among the most reliable technical indicators used in cryptocurrency analysis. These tools help identify entry and exit points, trend reversals, and momentum shifts.

Chart Patterns and Price Action

Understanding chart patterns like head and shoulders, triangles, and support/resistance levels is crucial for effective technical analysis. These patterns often repeat themselves and can provide valuable insights into future price movements.

Fundamental Analysis: The Foundation of Long-Term Investment

Fundamental analysis examines the underlying factors that contribute to a cryptocurrency’s value and growth potential. This approach is particularly important for long-term investors who want to understand the true value of their investments.

Project Evaluation Components

When conducting fundamental analysis, investors should examine the project’s whitepaper, team credentials, partnerships, use cases, and competitive advantages. The technology’s scalability, security features, and real-world adoption also play crucial roles in determining long-term value.

Market Adoption and Utility

Successful cryptocurrencies solve real-world problems and demonstrate growing adoption. Analyzing transaction volumes, active addresses, and developer activity provides insights into a project’s practical utility and growth trajectory.

On-Chain Analysis: The Blockchain Perspective

On-chain analysis represents the newest frontier in cryptocurrency evaluation, utilizing blockchain data to understand market dynamics and investor behavior patterns.

Key On-Chain Metrics

Important on-chain metrics include network hash rate, transaction fees, active addresses, and token distribution patterns. These metrics provide unique insights unavailable in traditional financial markets.

Whale Activity and Market Sentiment

Tracking large wallet movements and institutional activity helps predict market trends and potential price movements. On-chain analysis can reveal accumulation patterns and distribution phases that technical analysis might miss.

Combining Analysis Methods for Maximum Effectiveness

The most successful cryptocurrency investors combine all three analytical approaches to create a comprehensive investment strategy. Technical analysis provides timing, fundamental analysis ensures quality investments, and on-chain analysis offers unique blockchain-specific insights.Any particular geographic focus

Risk Management in Coin Analysis

Effective risk management involves setting stop-losses, diversifying portfolios, and never investing more than you can afford to lose. Understanding correlation patterns between different cryptocurrencies also helps in portfolio optimization.

Current Market Trends and Analysis Opportunities

As of 2025, several trends are shaping the cryptocurrency landscape. DeFi protocols, NFT ecosystems, and layer-2 solutions continue to drive innovation and create new investment opportunities. AI tokens and stablecoins are also gaining significant traction in the current market cycle.

Emerging Sectors for Analysis

Decentralized Physical Infrastructure Networks (DePIN), blockchain gaming, and Decentralized Science (DeSci) represent emerging sectors that require specialized analysis approaches. These sectors offer unique opportunities for investors who understand their fundamentals.

Tools and Resources for Coin Analysis

Professional traders and investors rely on various tools and platforms to conduct thorough coin analysis. Popular platforms include TradingView for technical analysis, CoinMarketCap for market data, and specialized on-chain analytics platforms like Glassnode and MMessariAny particular geographic focus

Free vs. Premium Analysis Tools

While many analysis tools offer free versions, premium subscriptions often provide advanced features, real-time data, and detailed research reports that can significantly improve investment decisions.

Common Mistakes in Coin Analysis

Many investors make critical errors when analyzing cryptocurrencies, including relying too heavily on one analysis method, ignoring market sentiment, or failing to consider regulatory risks. Understanding these common pitfalls helps investors make better decisions. Any particular geographic focus

Emotional Trading vs. Analytical Approach

Successful coin analysis requires discipline and emotional control. Fear of missing out (FOMO) and panic selling often lead to poor investment outcomes, regardless of how thorough the initial analysis was.

Conclusion

Mastering coin analysis is essential for anyone serious about cryptocurrency investing in 2025. By combining technical analysis, fundamental analysis, and on-chain metrics, investors can make more informed decisions and improve their chances of success in this dynamic market. Remember that effective coin analysis requires continuous learning, practice, and adaptation to market changes. Start implementing these analysis techniques in your investment strategy today, and always remember to conduct thorough research before making any investment decisions.