Managing your business finances doesn’t have to be overwhelming. This comprehensive small business accounting software tutorial will guide you through everything you need to know to streamline your financial processes and make informed business decisions. Whether you’re a startup owner or an established entrepreneur, understanding how to effectively use accounting software can save you countless hours and prevent costly mistakes.

In today’s digital landscape, small business owners who master accounting software gain a significant competitive advantage. This tutorial covers essential features, best practices, and step-by-step instructions to help you transform your financial management from chaotic to organized. By the end of this guide, you’ll confidently handle invoicing, expense tracking, financial reporting, and tax preparation using modern accounting tools.

Why Small Business Accounting Software is Essential

Small business accounting software has revolutionized how entrepreneurs manage their finances. Gone are the days of manual ledger books and spreadsheet nightmares. Modern accounting platforms offer automated features that reduce human error, save time, and provide real-time insights into your business performance.

The primary benefits include automated transaction categorization, seamless bank reconciliation, professional invoice generation, and comprehensive financial reporting. These tools help you maintain accurate records, comply with tax regulations, and make data-driven decisions that drive business growth.

Small Business Accounting Software Tutorial – Getting Started

Choosing the Right Software for Your Business

Before diving into the technical aspects, selecting the appropriate accounting software is crucial. Consider factors like your business size, industry requirements, budget constraints, and growth projections. Popular options include QuickBooks Online, Xero, FreshBooks, and Wave Accounting.

Evaluate each platform’s features, pricing structure, customer support quality, and integration capabilities with your existing business tools. Many providers offer free trials, allowing you to test functionality before committing to a subscription.

Initial Setup and Configuration

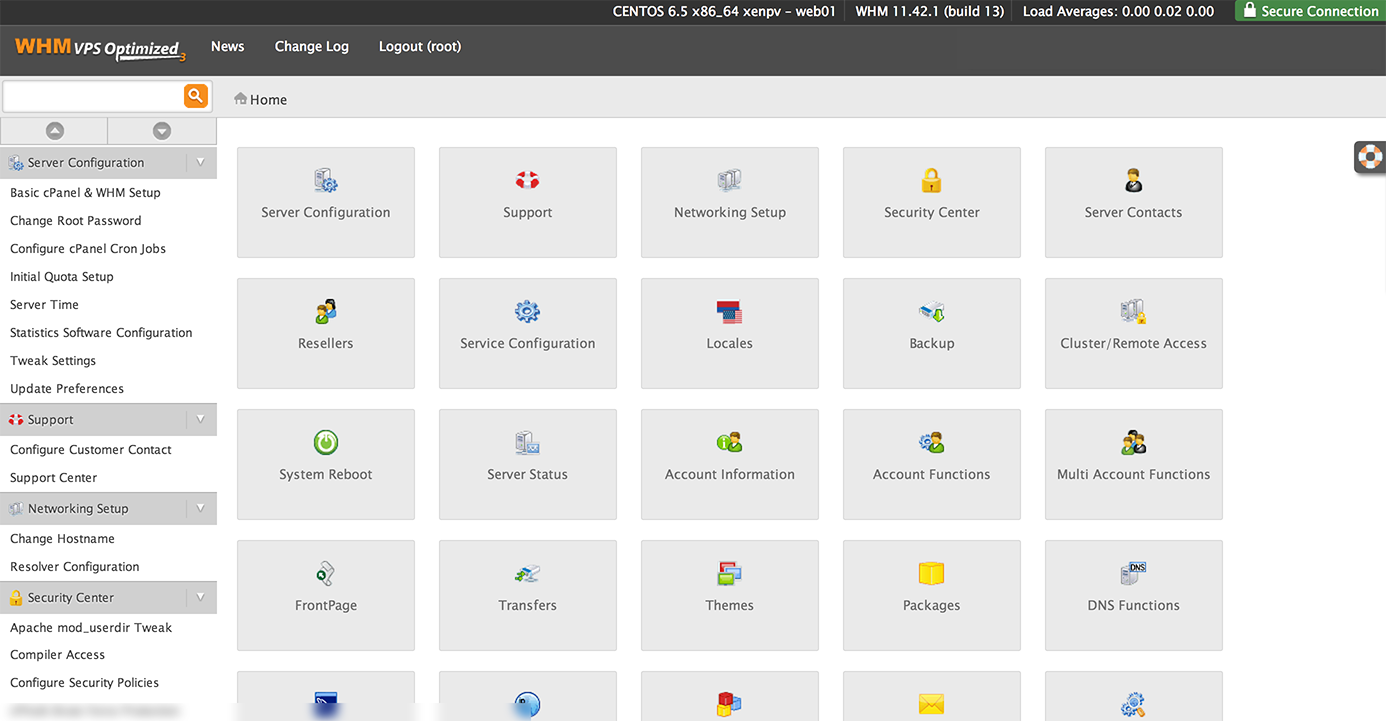

Once you’ve selected your preferred software, the setup process typically involves creating your company profile, configuring the chart of accounts, setting up bank connections, and customizing invoice templates. This foundational step ensures your accounting system accurately reflects your business structure and financial needs.

Start by entering your business information, including legal name, address, tax identification number, and fiscal year dates. Next, customize your chart of accounts to match your specific business categories and expenses.

Essential Features Every Small Business Owner Should Master

Invoicing and Payment Processing

Creating professional invoices is fundamental to maintaining healthy cash flow. Learn to customize invoice templates with your branding, set up recurring billing for regular clients, and integrate payment processing options like PayPal, Stripe, or Square.

Most accounting software allows you to track invoice status, send automated payment reminders, and generate aging reports to monitor outstanding receivables. These features help you maintain professional relationships while ensuring timely payments.

Expense Tracking and Management

Effective expense management directly impacts your bottom line and tax obligations. Modern accounting software offers receipt scanning capabilities, mileage tracking, and automatic expense categorization. Connect your business bank accounts and credit cards to automatically import transactions.

Create expense categories that align with tax deductions, making year-end reporting significantly easier. Regular expense monitoring helps identify spending patterns and opportunities for cost reduction.

Advanced Accounting Features for Growing Businesses

Financial Reporting and Analysis

Leverage built-in reporting tools to generate profit and loss statements, balance sheets, cash flow reports, and tax summaries. These reports provide valuable insights into your business performance and help identify trends, opportunities, and potential issues.

Customize reporting periods, compare year-over-year performance, and create visual dashboards that make financial data easy to understand. The regular financial analysis enables better decision-making and strategic planning.

Tax Preparation and Compliance

Accounting software simplifies tax preparation by organizing transactions, calculating deductions, and generating necessary tax forms. Many platforms integrate with popular tax software or connect directly with tax professionals.

Maintain detailed records throughout the year, categorize business expenses correctly, and generate quarterly reports for estimated tax payments. This proactive approach reduces stress during tax season and ensures compliance with regulations.

Best Practices for Small Business Accounting Software

Data Security and Backup

Protect your financial data by implementing strong passwords, enabling two-factor authentication, and regularly backing up your information. Choose software providers with robust security measures and compliance certifications.

Establish access controls for team members, limiting permissions based on job responsibilities. Regular data backups ensure business continuity even in case of technical issues or cyber threats.

Regular Reconciliation and Maintenance

Perform monthly bank reconciliations to ensure accuracy between your accounting records and bank statements. This practice helps identify discrepancies, unauthorized transactions, or data entry errors early. Schedule regular maintenance tasks like reviewing expense categories, updating customer information, and archiving old records. Consistent maintenance prevents small issues from becoming major problems.

Common Mistakes to Avoid

Many small business owners make preventable errors when using accounting software. Avoid mixing personal and business expenses, neglecting regular backups, or failing to reconcile accounts monthly. Don’t rely solely on automated categorization without manual review. Ensure proper user training for team members who access the system. Inadequate training leads to data entry errors, incorrect categorization, and workflow inefficiencies that can compromise financial accuracy.

Integration with Other Business Tools

Modern accounting software integrates seamlessly with various business applications, including customer relationship management (CRM) systems, e-commerce platforms, payment processors, and inventory management tools. These integrations eliminate duplicate data entry and provide comprehensive business insights.

Consider connecting your accounting software with tools like Shopify for e-commerce, Salesforce for customer management, or inventory systems for product-based businesses. Proper integration creates a unified business management ecosystem.

Conclusion

Mastering small business accounting software is essential for financial success in today’s competitive marketplace. This comprehensive tutorial provides the foundation needed to effectively manage your business finances, from basic setup to advanced reporting features. Ready to transform your financial management? Start implementing these small business accounting software tutorial strategies today. Choose the right software for your needs, invest time in proper setup, and maintain consistent practices for long-term success. Your future self will thank you for taking control of your business finances now.