The stock market rarely shows mercy to companies that fail to meet expectations, and recent trading sessions have demonstrated this harsh reality with brutal clarity. Strategy slides on earnings miss became the headline that dominated financial news outlets as the company experienced a significant downturn following its quarterly earnings report. The combination of underwhelming revenue numbers, reduced guidance, and a broader market selloff created the perfect storm for shareholders, many of whom watched their portfolios shrink as the company’s valuation took a substantial hit during extended trading hours.

When Strategy slides on earnings miss scenarios unfold, they often trigger a cascade of selling pressure as institutional investors reassess their positions and retail traders rush to cut their losses. Understanding what led to this disappointing performance and what it means for the company’s future requires a deeper examination of the financial results, market conditions, and the strategic challenges facing the organization.

Earnings Miss That Caused Strategy to Slide

The quarterly earnings report that triggered the Strategy slides on earnings miss reaction revealed several troubling trends that caught analysts and investors off guard. Revenue came in substantially below Wall Street expectations, with the company reporting figures that fell short of consensus estimates by a margin that even the most pessimistic forecasters had not anticipated. This shortfall was not merely a matter of missing the mark by a small percentage; the gap between expected and actual performance represented a fundamental disconnect between what management had projected and what the company could actually deliver in the current operating environment.

Breaking down the numbers reveals that multiple segments of the business underperformed simultaneously. The core business units that had traditionally driven growth showed signs of stagnation, while newer initiatives failed to gain the traction necessary to offset declining revenues in legacy operations. Cost management also emerged as a significant concern, with operating expenses rising faster than revenue growth, leading to compressed margins that disappointed investors who had been expecting improved profitability. When Strategy slides on earnings miss headlines emerged, they reflected not just a single quarter of weakness but raised questions about the company’s ability to execute on its long-term strategic vision.

The earnings per share figure painted an even grimmer picture, missing analyst expectations by a wide margin and representing a year-over-year decline that suggested the company was moving backward rather than forward. This metric is particularly important to investors because it directly impacts valuations and dividend sustainability. The combination of revenue shortfalls and declining profitability created a narrative of a company struggling to adapt to changing market conditions and competitive pressures.

Market Reaction and the Amplified Selloff

The immediate market reaction when Strategy slides on earnings miss news broke was swift and severe. Shares plummeted in after-hours trading, with the stock losing double-digit percentages of its value within minutes of the earnings release. This initial selloff was compounded by the fact that the broader market had already experienced a difficult trading session, with major indices closing lower on concerns about economic growth and interest rate policies. The timing could not have been worse, as investor risk appetite was already diminished, leaving little room for companies that delivered disappointing results.

When stocks break through key technical thresholds, it often triggers algorithmic selling and forces institutional investors who use stop-loss orders to exit their positions automatically. This mechanical selling can create a self-reinforcing downward spiral where the decline itself generates additional selling pressure, regardless of the fundamental value of the company. The volume of shares traded during this period was significantly above average, indicating that major institutional holders were repositioning their portfolios in response to the earnings disappointment.

The extended trading session revealed the full extent of investor concern, with the stock continuing to drift lower as market participants digested the earnings details and management commentary. The lack of concrete answers and the defensive posture adopted by management only reinforced negative sentiment and contributed to the continuation of the selloff when regular trading resumed the following day.

Analyzing the Root Causes Behind the Disappointing Performance

To understand why Strategy slides on earnings miss became such a dominant theme, we must examine the underlying factors that contributed to the disappointing quarterly performance. Industry headwinds played a significant role, with the company facing increased competition from both established rivals and emerging disruptors who were capturing market share with innovative products and aggressive pricing strategies. The competitive landscape had shifted dramatically over the past year, and the company appeared to be losing ground in key segments where it had previously held leadership positions.

Macroeconomic factors also weighed heavily on results. Consumer spending patterns had changed in response to inflationary pressures and rising interest rates, leading to reduced demand for the company’s products and services. Business customers, meanwhile, were tightening their budgets and postponing investment decisions, creating headwinds for enterprise-focused offerings. These external pressures exposed weaknesses in the company’s business model and raised questions about whether management had adequately prepared for a more challenging operating environment.

Internal execution issues compounded the external challenges. When Strategy slides on earnings miss situations occur, they often reveal that the company has been struggling with operational challenges that were not fully apparent to outside observers. The earnings report pulled back the curtain on these difficulties and forced management to acknowledge that the path forward would be more difficult than previously communicated.

Impact on Investor Confidence and Future Outlook

The Strategy slides on earnings miss episode has had profound implications for investor confidence in the company’s ability to deliver on its promises. Trust is a critical component of the relationship between a company and its shareholders, and when that trust is damaged by disappointing results and unmet expectations, it can take considerable time and effort to rebuild. The sharp decline in the stock price reflects not just the current quarter’s underperformance but also increased uncertainty about future quarters and the company’s long-term growth trajectory.

Analyst downgrades followed swiftly in the wake of the earnings release, with multiple Wall Street firms reducing their price targets and revising their revenue and earnings estimates for the coming quarters. Some analysts moved from buy ratings to hold or even sell recommendations, citing concerns about the company’s competitive position and execution capabilities. These downgrades create additional selling pressure as institutional investors who follow analyst guidance adjust their positions accordingly. The consensus view among market observers shifted from cautious optimism to skepticism about whether management can successfully navigate the current challenges.

The guidance provided by management for the upcoming quarter and full fiscal year did little to restore confidence. Projections were reduced across multiple metrics, and the commentary suggested that the company expects continued pressure on both revenues and margins. When companies experience situations where Strategy slides on earnings miss dynamics take hold, the revised guidance often becomes a self-fulfilling prophecy as customers, partners, and employees react to the negative momentum and uncertainty. The lowered expectations set a new baseline that the company will need to meet or exceed to begin rebuilding investor confidence.

Comparing Strategy’s Performance to Industry Peers

Context matters tremendously when evaluating whether Strategy slides on earnings miss represents a company-specific problem or reflects broader industry trends. A comparative analysis of peer company performance during the same period reveals a mixed picture. Some competitors managed to meet or exceed expectations despite facing similar macroeconomic headwinds, suggesting that Strategy’s challenges may be at least partially self-inflicted rather than purely the result of external factors. These successful peers demonstrated better cost control, more effective product innovation, and superior execution on strategic initiatives.

Market share data tells a particularly revealing story. While the overall market for the company’s products and services grew modestly during the quarter, Strategy’s share of that market declined, indicating that competitors were capturing the available growth. This loss of market share is especially concerning because it suggests that customers are actively choosing alternative solutions, whether due to better features, lower prices, or superior service. When Strategy slides on earnings miss scenarios unfold alongside declining market share, it signals that the company is not just struggling with temporary headwinds but may be losing its competitive edge in a fundamental way.

Profitability metrics also show Strategy lagging behind industry averages. While some compression in margins might be expected during challenging periods, the company’s margins deteriorated more rapidly than those of its peers, raising questions about operational efficiency and pricing power. Companies with strong competitive positions can typically maintain pricing discipline even during difficult periods, whereas those with weakening positions often find themselves forced to discount to maintain volume, which further pressures profitability. The comparison to peers suggests that Strategy faces deeper structural challenges that will require more than just a cyclical recovery to address effectively.

Strategic Implications and Management Response

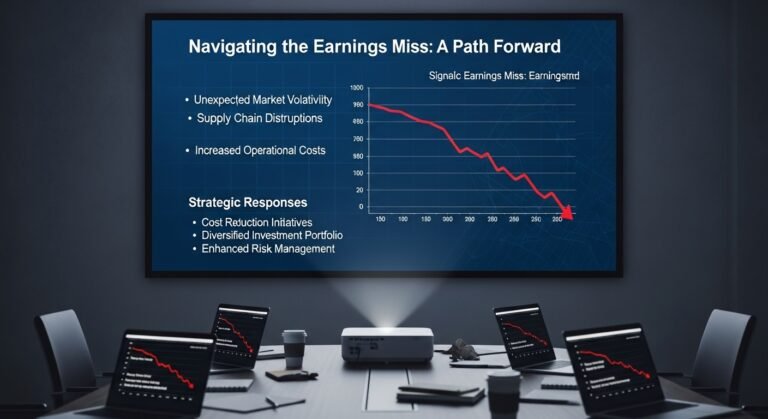

The response from company leadership when Strategy slides on earnings miss events occur can make a significant difference in how quickly the company recovers. Management announced a series of initiatives designed to address the shortcomings revealed in the earnings report, including cost reduction programs, strategic reviews of underperforming business units, and accelerated investment in growth areas that show more promise. The credibility of these initiatives will depend heavily on execution and whether they address the root causes of the company’s challenges rather than just treating symptoms.

Restructuring plans were outlined that involve workforce reductions, facility consolidations, and the elimination of redundant systems and processes. These measures are expected to generate substantial cost savings over the next several quarters, though they will also result in one-time charges that will further depress near-term earnings. The market typically responds positively to decisive action, but investors will be watching closely to ensure that cost-cutting does not compromise the company’s ability to invest in innovation and growth. There is a delicate balance between achieving operational efficiency and maintaining the capabilities needed to compete effectively in the long term.

Leadership changes may also be on the horizon if performance does not improve. The board of directors faces pressure from shareholders to hold management accountable for the disappointing results and the erosion of shareholder value. When Strategy slides on earnings miss becomes a recurring theme rather than an isolated incident, boards often conclude that new leadership is necessary to change the company’s trajectory. Speculation about potential CEO succession and other executive changes has begun to circulate in financial media, adding another layer of uncertainty to the company’s outlook.

What This Means for Different Types of Investors

Growth investors who were attracted to Strategy based on its expansion prospects face a more difficult decision. The reduced guidance and slower growth trajectory make the stock less attractive from a growth investing perspective, and many growth-focused funds have likely already exited their positions or significantly reduced their exposure. The growth investing community tends to be less forgiving of execution missteps and guidance reductions because these factors directly contradict the investment thesis. For these investors, the Strategy slides on earnings miss episode may represent a permanent elimination of the stock from their investable universe until the company can demonstrate a return to sustainable growth.

Investors who depend on dividend income must carefully weigh the attractive current yield against the risk of a potential reduction or elimination of the payment.

Technical Analysis and Price Action Considerations

From a technical perspective, the move where Strategy slides on earnings miss has created significant damage to the stock’s chart pattern. The breakdown below key support levels has turned what was previously a consolidation pattern into what technical analysts describe as a bearish continuation pattern. The stock has crossed below its 50-day and 200-day moving averages, both of which are considered important technical indicators. When a stock trades below these moving averages, it suggests that the medium-term and long-term trends have turned negative, and momentum traders who follow technical signals are likely to remain sellers until these technical conditions improve.

Volume patterns during the decline have been particularly heavy, which technical analysts interpret as evidence of conviction behind the selling pressure. High volume on down days suggests that institutional investors are actively reducing positions rather than simply retail investors reacting emotionally to negative news. This institutional selling creates significant overhead resistance that will make it difficult for the stock to recover even if sentiment begins to improve.

Momentum indicators such as the Relative Strength Index and MACD have turned deeply oversold, which might suggest that a short-term bounce could occur as traders who are short the stock take profits. However, oversold conditions can persist for extended periods during strong downtrends, and attempting to catch falling knives based solely on oversold readings is a risky strategy. The technical picture will not improve until the stock can establish a series of higher lows and higher highs, breaking the current pattern of lower lows and lower highs that characterizes a downtrend.

Lessons for the Broader Investment Community

The episode where Strategy slides on earnings miss offers valuable lessons for investors across all market segments. The importance of diversification becomes evident when examining the impact on portfolios that had concentrated positions in the stock. Investors who maintained appropriate diversification were able to absorb the loss as one component of a broader portfolio, while those with oversized positions experienced disproportionate damage to their overall wealth. This serves as a reminder that even stocks that appear to be solid investments can experience sudden and severe declines when circumstances change.

The danger of ignoring warning signs is another critical lesson. In retrospect, there were indications in previous quarters that all was not well at Strategy, including slowing growth rates, increasing competition, and subtle changes in management commentary. Investors who paid close attention to these early warning signals had the opportunity to reduce their positions before the strategy’s slide on the earnings miss event inflicted maximum damage.

Developing the ability to recognize deteriorating fundamentals before they become obvious to the broader market is one of the key skills that separates successful investors from those who consistently buy high When stocks decline sharply, the natural human tendency is to either panic sell at the worst possible moment or to engage in wishful thinking that problems will resolve themselves without further pain. Neither extreme is typically optimal. The most successful investors maintain a systematic approach to evaluating whether their investment thesis remains intact and make decisions based on updated analysis rather than emotional reactions to price movements.

The Road Ahead and Recovery Prospects

Looking forward from the point where Strategy slides on earnings miss dominated market conversation, the path to recovery will require multiple consecutive quarters of improved performance and restored credibility with the investment community. Management faces the challenge of not only meeting the reduced expectations they have set but exceeding them to begin rebuilding the premium valuation the stock once commanded. This will require flawless execution on strategic initiatives, successful product launches, market share gains, and margin expansion—a tall order in the current environment.

The timeline for recovery is uncertain and will depend on numerous factors including macroeconomic conditions, competitive dynamics, and the company’s ability to execute its turnaround plan. During this period, the stock may languish or trade in a range as investors adopt a wait-and-see approach.

External factors beyond management’s control will also play a role in determining recovery prospects. If the broader economic environment improves and industry growth accelerates, Strategy will benefit from those tailwinds. Conversely, if economic conditions deteriorate or competitive pressures intensify, even excellent execution may not be sufficient to generate the kind of results that would drive significant stock appreciation. When evaluating situations where Strategy slides on earnings miss, investors must consider both company-specific factors and broader contextual elements that will influence outcomes.

Conclusion

The sharp decline that occurred when Strategy slides on earnings miss became reality serves as a powerful reminder of the risks inherent in equity investing and the importance of thorough due diligence. The company faces significant challenges in the quarters ahead as it works to address operational shortcomings, restore investor confidence, and demonstrate that it can return to a growth trajectory. For investors considering whether to buy the dip, maintain current positions, or exit entirely, the decision must be based on a careful assessment of whether the current price adequately reflects the risks and whether management has a credible plan to address the fundamental issues that led to this disappointing performance.

The broader investment community will be watching closely to see how Strategy responds to this crisis. Companies that successfully navigate earnings misses and subsequent selloffs often emerge stronger and more focused, having eliminated inefficiencies and recommitted to disciplined execution. However, those that fail to address root causes or lack the leadership capability to drive meaningful change may continue to struggle and deliver further disappointments. The coming quarters will reveal which path Strategy will follow.

Whether you are a current shareholder grappling with the decision of what to do next, or a potential investor evaluating whether the Strategy slides on earnings miss has created an attractive entry point, staying informed about the company’s progress on its turnaround initiatives will be essential. Monitor quarterly results closely, pay attention to changes in competitive positioning, and assess whether management’s actions match their rhetoric. The stock market eventually rewards companies that execute and punishes those that disappoint, making careful ongoing analysis critical for anyone with exposure to this situation.

See more; Altcoin News Today: NTRN, GPS & PARTI Lead Market Gains